U.S. Record Crude-Oil Production Could Happen by 2016

Tuesday, December 17, 2013

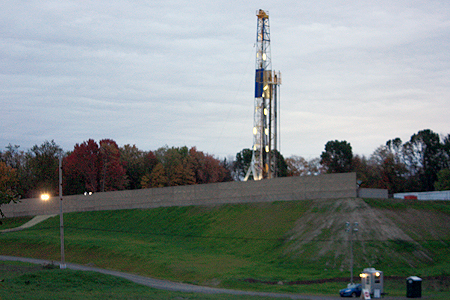

The United States is on track to reach record production of crude-oil, due in part to hydraulic fracturing, according to the Wall Street Journal.

The increased production could bring lower prices to the gas pump.

Read it:

“The rising U.S. production “will weigh heavily on oil prices,” said Ed Morse, head of commodity research at Citigroup. He said he believes that in the second half of the decade the global benchmark price will be $15 a barrel below where it is now.

“It could be a lot lower if the shale revolution continues around the world” as expected, Mr. Morse said.”

History

The recent uptick in production has prompted oil producers to push for lifting restrictions on oil exports. The U.S. hasn’t exported oil since 1973. Since then the U.S. has taken production from a 62-year low to an almost all-time high.

Allowing oil exports could benefit large production companies like Exxon. Selling oil on a global market may allow the company to sell the oil at a higher price.

Natural gas

Other numbers suggest the U.S. could be a net exporter of natural gas by 2018.